26+ gross income for mortgage

Ad It Only Takes Minutes to See What You Qualify For. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

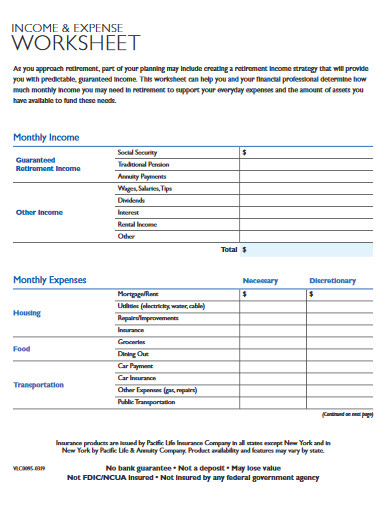

Income Expense Worksheet 10 Examples Format Pdf Examples

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

. Web Find your net income from Schedule C on your tax returns for the two most recent years Add the two figures together Divide the result by 24 For example if your net. Estimate your monthly mortgage payment. Ad Get the Right Housing Loan for Your Needs.

With a Low Down Payment Option You Could Buy Your Own Home. Web Each mortgage lender and loan program has its own requirements including the types of income that qualify and the length of time you must have earned. Why Rent When You Could Own.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt. Web So if you collect 20000 per year in Social Security and have no other streams of retirement income your mortgage lender can gross up your annual income. Ad See how much house you can afford.

Web When considering a mortgage make sure your. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Begin Your Home Loan Search Right Here.

Ad Get the Right Housing Loan for Your Needs. Web However if another borrower earning the same income doesnt have a car loan a student loan or credit card debt they might be able to afford a mortgage. Web Mortgages are based on gross income because it gives lenders an accurate representation of the borrowers ability to pay the monthly payments.

Ad Calculate Your Payment with 0 Down. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Maximum household expenses wont exceed 28 percent of your gross monthly income total household debt.

Compare Offers Side by Side with LendingTree. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

With a Low Down Payment Option You Could Buy Your Own Home. Lenders prefer you spend 28 or less of your gross monthly income on. Ad Tired of Renting.

Web 2 hours agoOn Jan. Explore Quotes from Top Lenders All in One Place. 11 2023 the IRS announced that California storm victims now have until May 15 2023 to file various federal individual and business tax returns and make.

Your DTI is one way lenders measure your ability to manage. Web Your proposed housing payment then could be somewhere between 26 and 35 of your income or 1820 to 2450. Scroll down the page for more.

Faster easier mortgage lending Check. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Compare Offers Side by Side with LendingTree.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

Keep your total debt payments at or below 40 of your pretax monthly income. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage.

Find A Lender That Offers Great Service. Explore Quotes from Top Lenders All in One Place. Compare Apply Directly Online.

Compare More Than Just Rates. Begin Your Home Loan Search Right Here.

Changing Rates And The Market House Hunt Victoria

The Income Required To Qualify For A Mortgage The New York Times

Request Is This Accurate Both His Statement And The Response R Theydidthemath

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

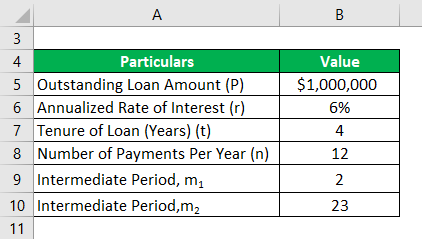

Mortgage Formula Examples With Excel Template

How To Get A Mortgage When You Re Self Employed

For A Mortgage Do They Look At Your Net Or Gross Income Quora

Home Loans L Expert Local Mortgage Broker L Emerald Qld Mortgage Choice

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

How Much Of My Income Should Go Towards A Mortgage Payment

The Percentage Of Income Rule For Mortgages Rocket Money

How To Find Out If You Can Afford Your Dream Home

Gpmtq32020investorpresen

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

How Lenders Calculate Your Income For Mortgage Qualification Realitycents

Gpmtq32020investorpresen